A Summary of Recent Announcements from Listed Companies in Shanghai and Shenzhen Stock Exchanges

8|0条评论

Several listed companies in Shanghai and Shenzhen released important announcements on January 24th. Key highlights include:

R&D and Business Updates:

- 康泰生物 (Kangtai Bio): Discontinued the development of its Vero cell inactivated COVID-19 vaccine to optimize research resources. This will not significantly impact other projects or the company’s overall performance.

- 新炬网络 (Xinju Network): Clarified the distinction between its IT operation and maintenance intelligent system and general AI systems. The former is still under development and hasn’t generated revenue yet. The company emphasized that its core business remains unchanged.

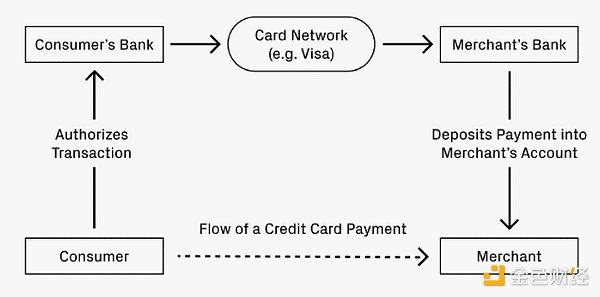

- 比亚迪 (BYD): Plans to use foreign exchange derivatives for hedging up to $50 billion USD equivalent to mitigate currency fluctuations.

- 皖通高速 (Wantong Expressway): Plans a 123.03 billion yuan investment in the Gaoxie Expressway expansion project.

- 古越龙山 (Guyue Longshan): Terminated its participation in an industrial investment fund due to a lack of investment projects.

Financial Performance and Risk Disclosures:

- ST英飞拓 (ST Yingfeituo): Is under investigation by the China Securities Regulatory Commission (CSRC) for suspected violations of information disclosure regulations.

- 原尚股份 (Yuanshang Shares), *ST天创 (*ST Tianchuang), 岩石股份 (Yanshi Shares), 太和水 (Taihe Water): These companies announced potential delisting risks due to anticipated net losses and/or revenue below the threshold.

- 歌尔股份 (Goertek): Projected a 135%-155% year-on-year increase in net profit for 2024, driven by increased demand in the consumer electronics sector and the success of its VR/MR and wearable products.

- 中国人寿 (China Life Insurance) and 中国人保 (China Pacific Insurance): Both projected significant year-on-year increases in net profit for 2024, largely attributed to increased investment returns.

- 上汽集团 (SAIC Motor): Anticipated a significant decrease in net profit (87%-90%) for 2024, primarily due to a decrease in sales volume and intensified price competition in the fuel vehicle market.

- 中集集团 (CIMC Group) and 中通客车 (Zhongtong Bus): Both companies projected substantial year-on-year increases in net profit for 2024 due to strong demand in their respective sectors.

- 东方盛虹 (Dongfang Shengrong), 机器人 (Robot), 上海家化 (Shanghai Jahwa), and 诺德股份 (Nord Shares): These companies reported anticipated losses for 2024 due to various factors such as market price fluctuations, decreased investment returns, and impairment of assets.

- 交大昂立 (Jiaotong University Angli): Expects a return to profitability in 2024.

- 协创数据 (Xichuang Data): Projected a significant increase in net profit (137.16%-189.86%) for 2024 due to strong growth across several business lines.

Shareholder Activities:

- 万凯新材 (Wankai New Materials): Its controlling shareholder plans to increase its shareholding by 10 million to 20 million yuan.

- 利元亨 (Liyuanheng): Its chairman proposed a share buyback program of 30 million to 40 million yuan.

股票型基金

MORE>-

感谢分享博时价值增长贰号混合基金的分析!文中提到基金经理任职时间较短,以及重...

-

感谢分享!最近市场确实波动很大,文章建议暂停交易、降低风险,非常实用。我会谨...

-

感谢分享工银战略转型股票A的基金信息和区块链视角分析。近一年收益率不错,但缺...

-

感谢分享!文章信息量挺大,特别是提到了政策利好刺激以及创业板的风险与机遇,让...

-

这篇报告数据详实,特别是关于线上销售和女性骑行用户增长的部分很有参考价值。不...

- 最近发表